Migros results for full year 2018

05 March 2019

§ Store Network

238 new stores in 2018

Financial Highlights

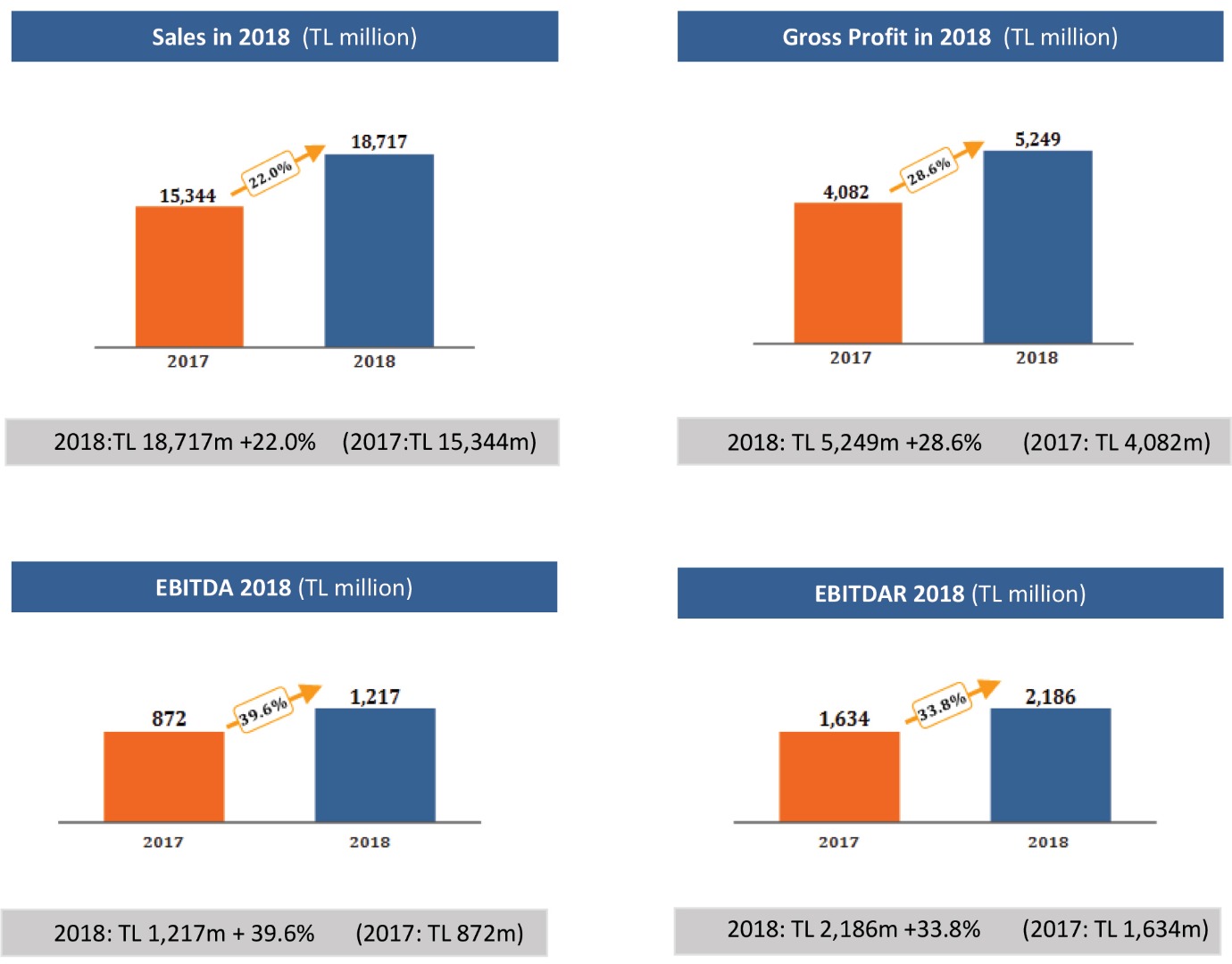

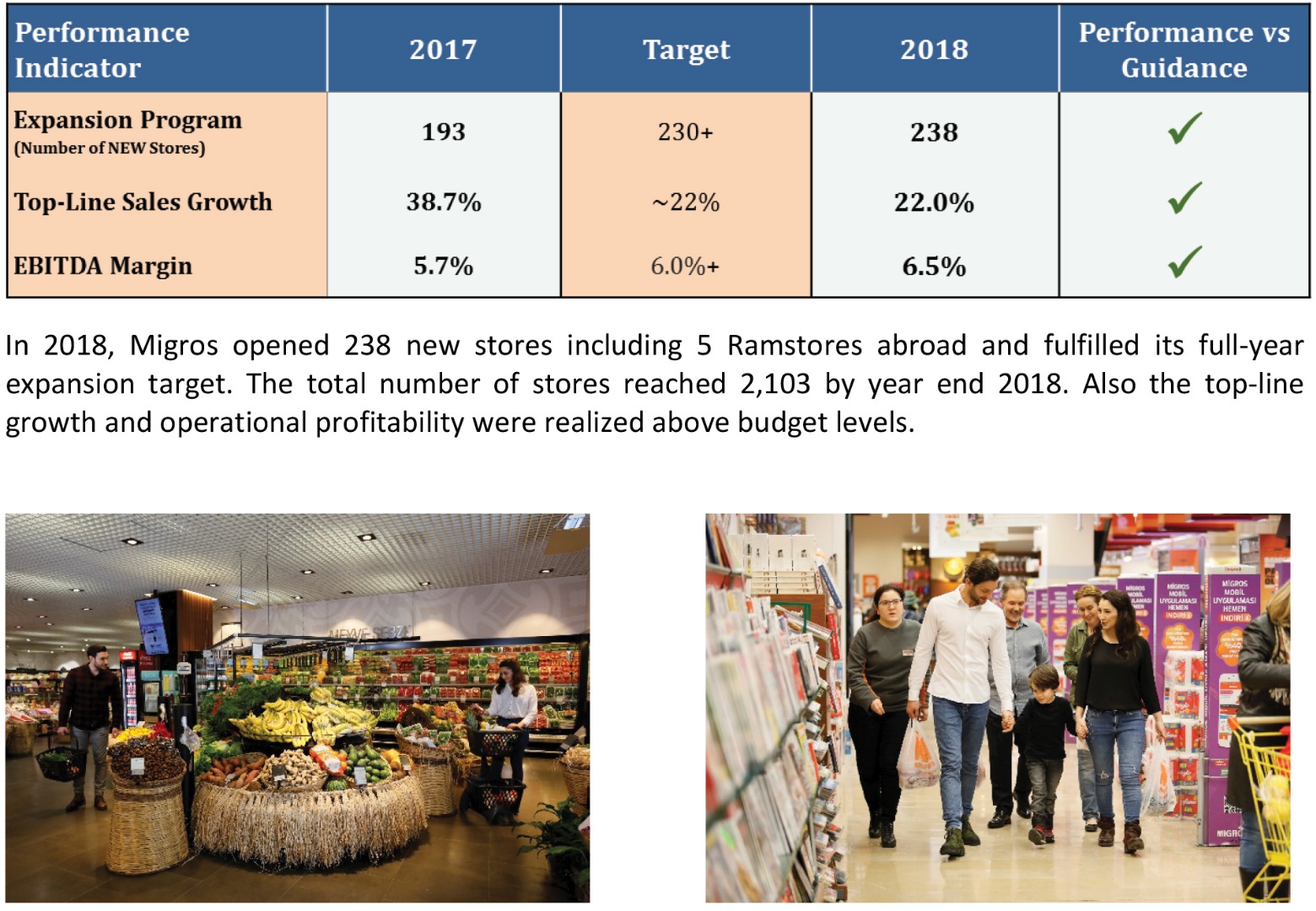

Migros’ consolidated sales grew 22% in 2018 and reached TL 18.7 billion. With 238 new stores in its network, Migros generated TL 1,217 mn EBITDA (Earnings before Interest, Taxes, Depreciation and Amortization). The annual EBITDA growth of 39.6% is driven by higher gross profitability, and better fixed cost absorption due to higher nominal sales. The strong sales performance of seasonal stores located in touristic regions also contributed the top-line growth of the Company. Migros reached its historical EBITDA margin of 6.5% in 2018, which is indicative of the successful integration of the Kipa, Uyum and Makro stores. Migros recorded TL 2,186 mn consolidated EBITDAR (EBITDA before rent) in 2018, representing a margin of 11.7%.

In spite of strong operational performance, the depreciation of TL against Euro increased FX losses and the Company recorded a net consolidated loss of TL 835 mn in 2018 due to higher financial expenses.

Migros, doubled its sales revenues from TL 9,390 mn to TL 18,717 mn in the past 3 years and opened 663 new stores as part of its organic expansion program. Migros over-achieved its sales target without sacrificing its operational profitability. The Company doubled its EBITDA generation from TL 602 mn to TL 1,217 mn in 3 years between 2015 and 2018. Migros is very much on track in implementing its growth plan; it continues to expand its private label assortment and to give the best value to its customers. More efficient supply chain solutions, a wide network of fresh procurement and enhanced meat processing capabilities contribute to strengthening its competitive power. The company’s focus in the age of digitalisation remains providing the best customer experience and offering customers the ultimate convenience of shopping anytime, anywhere.

Operational Highlights

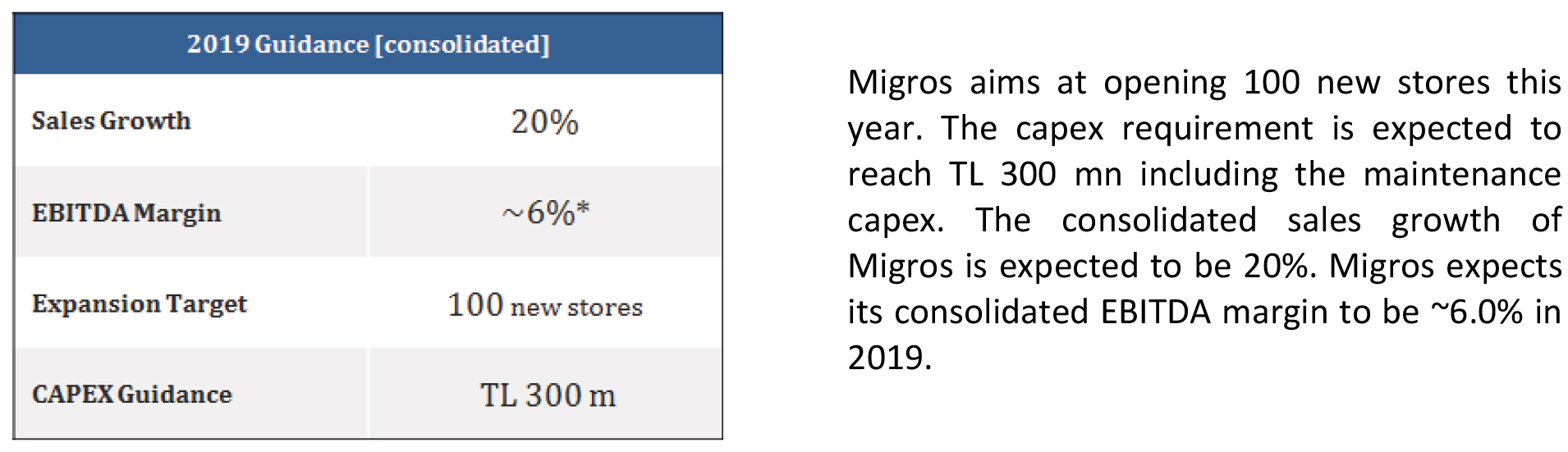

Migros made its third TL bond issuance in February 2019 to qualified investors including the EBRD (European Bank for Reconstruction and Development); the total outstanding TL medium-term bonds reached TL 396 mn including the issuances in 2018. Fitch Ratings’ national long-term rating of Migros is investment grade A+ (Stable). The company is well on track in reducing its foreign currency debt exposure in 2019.

*excluding IFRS 16 impact

Please visit www.migroskurumsal.com for further information.